Decentralized Finance (DeFi): Unveiling the Blockchain Revolution in Finance

In the ever-evolving landscape of finance, the emergence of blockchain technology has paved the way for a revolutionary kind of financial system known as Decentralized Finance, or DeFi. This section serves as a precursor to understanding the transformative impact of DeFi on the financial sector, setting the stage for a deep dive into its core concepts, applications, and future prospects.

Background of Financial Systems

Traditionally, financial systems have been centralized, with a handful of powerful institutions controlling the majority of financial transactions and services. These institutions, including banks and government bodies, act as intermediaries, facilitating transactions and imposing regulations. However, this centralized approach has its drawbacks, including high fees, slower transaction times, and a lack of transparency.

| Centralized Finance | Decentralized Finance (DeFi) |

|---|---|

| Controlled by a few institutions | Operated on a decentralized network |

| High transaction fees | Lower transaction fees |

| Slower transaction times | Faster transaction times |

| Limited transparency | Enhanced transparency |

| Prone to single points of failure | Resilient to single points of failure |

Emergence of Blockchain Technology

Blockchain technology emerged as a beacon of hope, promising to address the shortcomings of the centralized financial system. Initially conceived to support cryptocurrencies like Bitcoin, blockchain has evolved to foster a more transparent, secure, and efficient financial ecosystem. Its decentralized nature eliminates the need for intermediaries, offering a peer-to-peer network where transactions are recorded on a public ledger, ensuring transparency and security.

In this decentralized framework, each transaction is recorded in a block and linked to the preceding and succeeding blocks, forming a chain. This structure, known as the blockchain, is immutable, meaning that once a transaction is recorded, it cannot be altered, thus providing a high level of security against fraud and manipulation.

Overview of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a natural progression in the evolution of blockchain technology. It leverages the principles of blockchain to create an open-source, permissionless, and transparent financial service ecosystem. DeFi aims to democratize finance by enabling every individual to access financial services without the need for a central authority or intermediary.

In the DeFi landscape, financial products are accessible to anyone with an internet connection, fostering financial inclusion and equality. It offers a plethora of financial services, including lending, borrowing, trading, investment, and insurance, all operating on decentralized platforms.

By mastering the foundational knowledge presented in this section, readers will be well-prepared to explore the intricate world of DeFi, delving deeper into its core concepts, applications, and the transformative potential it holds for reshaping the financial landscape.

Understanding the Core Concepts

What is Decentralized Finance (DeFi)?

Decentralized Finance, commonly known as DeFi, represents a shift from traditional, centralized financial systems to an open, transparent, and permissionless financial ecosystem. Leveraging blockchain technology, DeFi offers a platform where financial products are available on a public decentralized blockchain network. This means that these services are not controlled by any single entity and are accessible to anyone, fostering a more inclusive and democratized financial system.

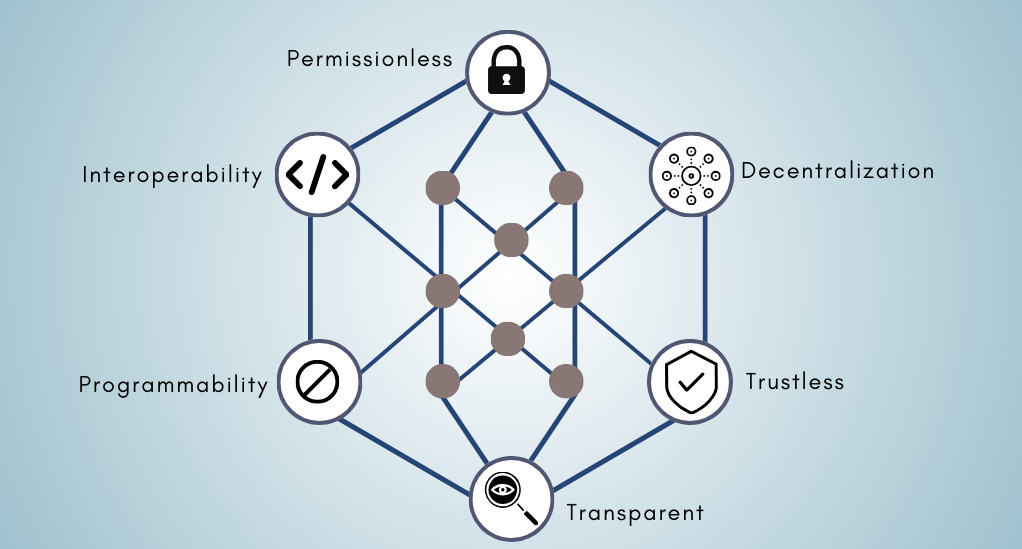

Key Principles of DeFi

DeFi operates on several foundational principles that set it apart from traditional finance. These principles include:

- Permissionless: Allows anyone to participate without the need for approval from a central authority.

- Transparency: All transactions are recorded on a public ledger, promoting transparency and trust.

- Interoperability: DeFi platforms can interact with each other, facilitating a more integrated and efficient ecosystem.

- Self-Custody: Users have full control over their assets, without the need to entrust them to a third party.

- Programmability: Financial services and products can be automatically executed through smart contracts, reducing the need for intermediaries and lowering costs.

How Does DeFi Differ from Traditional Finance?

Understanding the differences between DeFi and traditional finance is crucial to grasping the revolutionary potential of DeFi. Here, we delineate the stark contrasts between the two:

| Traditional Finance | Decentralized Finance (DeFi) |

|---|---|

| Centralized control and authority | Decentralized and open-source |

| Restricted access based on geography and socio-economic status | Universal access to anyone with an internet connection |

| Reliance on intermediaries, leading to higher costs | Peer-to-peer transactions, reducing costs |

| Limited transparency and potential for manipulation | Enhanced transparency with transactions recorded on a public ledger |

| Slower innovation due to bureaucratic hurdles | Rapid innovation due to programmability and open-source nature |

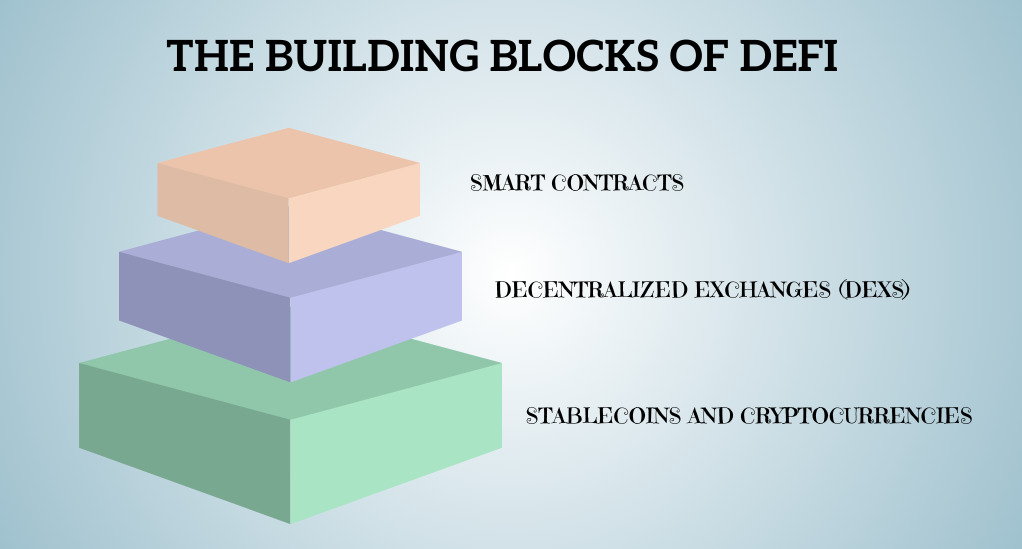

The Building Blocks of DeFi

Smart Contracts

At the heart of DeFi are smart contracts, self-executing contracts with the terms of the agreement directly written into code. These digital contracts automatically execute actions when predetermined conditions are met, eliminating the need for intermediaries and reducing the potential for fraud. Smart contracts play a pivotal role in facilitating transactions and defining the rules within various DeFi applications.

Decentralized Exchanges (DEXs)

Decentralized exchanges, or DEXs, are platforms that allow for the peer-to-peer trading of assets without the need for a central authority or intermediary. DEXs provide a transparent, secure, and open marketplace for trading cryptocurrencies and other digital assets. Users retain full control over their private keys and funds, promoting a higher level of security compared to centralized exchanges.

Stablecoins and Cryptocurrencies

Stablecoins are a type of cryptocurrency that is pegged to the value of a stable asset, such as a specific amount of a fiat currency. They combine the benefits of digital currencies, like security and transparency, with the stability of traditional currencies. Cryptocurrencies, on the other hand, are digital or virtual currencies that use cryptography for security and operate independently of a central bank. Both stablecoins and cryptocurrencies serve as vital components in the DeFi ecosystem, facilitating various financial transactions and services.

Applications and Use Cases

- Lending and Borrowing

DeFi platforms have revolutionized lending and borrowing, offering peer-to-peer services that are more accessible and cost-effective. Users can lend their assets to earn interest or borrow assets for various financial activities, all without the need for a central authority. These platforms often utilize smart contracts to automate the lending and borrowing process, ensuring security and transparency.

- Yield Farming

Yield farming, also known as liquidity mining, is a method used to earn rewards by providing liquidity to a DeFi service. Users can stake their assets in a liquidity pool to earn interest or rewards, often in the form of tokens. This innovative practice incentivizes participation and helps to stabilize the DeFi ecosystem.

- Insurance

DeFi is also making waves in the insurance sector, offering decentralized insurance products that provide coverage for various risks associated with digital assets and smart contracts. These decentralized insurance platforms operate transparently on blockchain networks, allowing users to purchase and claim insurance without the need for intermediaries.

- Asset Management

Asset management in the DeFi sector involves platforms and protocols that allow users to manage their digital assets more efficiently. These platforms offer a range of services, including investment strategies, portfolio management, and automated asset allocation, all operating on decentralized networks.

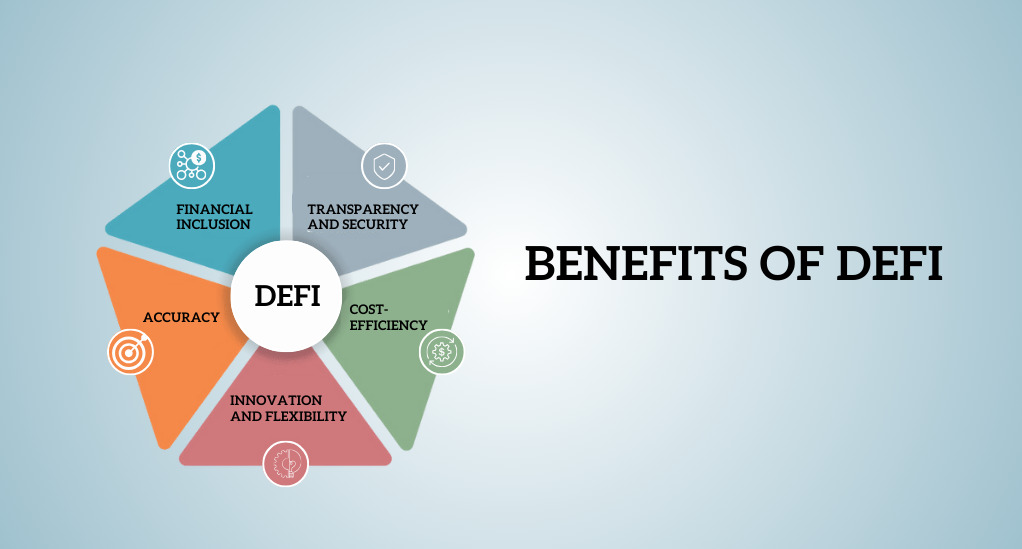

Benefits of DeFi

1. Financial Inclusion

One of the most significant advantages of DeFi is its potential to foster financial inclusion. By removing barriers to entry, DeFi allows individuals from all walks of life, including those in unbanked and underbanked regions, to access financial services. This democratization of finance could potentially uplift millions of people by providing them with the tools necessary to participate in the global economy.

2. Transparency and Security

DeFi platforms operate on blockchain technology, which records all transactions on a public ledger. This transparency ensures that all activities are open for verification, fostering trust and reducing the likelihood of fraud. Moreover, the decentralized nature of blockchain technology means that it is secure against attacks that usually target centralized databases.

3. Cost-Efficiency

By eliminating intermediaries and utilizing automated smart contracts, DeFi platforms can significantly reduce the costs associated with financial transactions. This cost-efficiency is a boon for users, who can enjoy lower fees and better rates compared to traditional financial systems.

4. Innovation and Flexibility

The open-source nature of DeFi platforms encourages innovation, as developers from around the world can collaborate and contribute to the ecosystem. This collaborative environment fosters rapid development and the creation of flexible, user-centric financial products and services.

Challenges and Concerns

1. Scalability Issues

As the DeFi sector grows, scalability becomes a pressing concern. Current blockchain networks may face challenges in handling a surge in the number of transactions, potentially leading to slower processing times and higher fees. Innovations in blockchain technology are continually being developed to address these scalability issues.

2. Regulatory Hurdles

The decentralized and open-source nature of DeFi presents regulatory challenges. Governments and regulatory bodies are grappling with how to regulate DeFi platforms to prevent misuse while still encouraging innovation. The evolving regulatory landscape is something that participants in the DeFi space need to monitor closely.

3. Security Vulnerabilities

While blockchain technology is inherently secure, the complex nature of DeFi platforms can sometimes introduce security vulnerabilities. These vulnerabilities can be exploited by malicious actors, leading to hacks and loss of funds. Continuous efforts are being made to enhance the security protocols within the DeFi space.

The Future of DeFi

1. Integration with Traditional Finance

Looking ahead, DeFi is poised to integrate more closely with traditional financial systems. This integration could see the creation of hybrid models that combine the best features of both worlds, offering users a more comprehensive range of financial services.

2. Potential Innovations and Developments

The DeFi sector is ripe for innovation, with numerous developments on the horizon. From the creation of more sophisticated financial products to the introduction of new technologies that enhance usability and security, the future of DeFi looks promising.

3. The Role of DeFi in the Global Financial Landscape

As DeFi continues to grow, it is set to play an increasingly significant role in the global financial landscape. By offering a more inclusive, transparent, and efficient financial system, DeFi has the potential to reshape the world of finance as we know it.

Conclusion

Decentralized Finance (DeFi), powered by blockchain technology, stands at the forefront of a financial revolution, promising a more inclusive, transparent, and efficient financial ecosystem. As we explore this innovative domain, we encounter a wealth of opportunities that democratize access to financial services, breaking away from the confines of traditional systems. DeFi’s core principles foster a more egalitarian financial landscape, opening doors to a broader segment of the population.

Looking ahead, the journey of DeFi is both exhilarating and fraught with challenges. The sector is primed for continuous innovation, potentially merging with traditional financial systems to forge a comprehensive service range. However, it’s crucial to adeptly navigate forthcoming challenges, including scalability issues and regulatory complexities. As active participants in this vibrant ecosystem, we are on a transformative path that heralds a new era of financial inclusivity and innovation, reshaping the global financial canvas with unprecedented opportunities and advancements.

Leave a Reply