How to Invest in Blockchain Technology

In recent years, the financial landscape has undergone a seismic shift, largely propelled by the advent of blockchain technology. Often hailed as the backbone of the new-age digital economy, blockchain has transcended its initial association with cryptocurrencies, paving the way for a plethora of investment opportunities. As we stand on the cusp of a financial revolution, understanding and investing in blockchain technology has become more than just a trend; it’s a necessity for those looking to stay ahead in the investment game.

In this guide, we embark on a journey to unravel the intricacies of blockchain technology and explore the avenues through which you can invest and potentially reap substantial benefits. Whether you are a seasoned investor eyeing new horizons or a novice stepping into the world of digital assets, this guide promises to be your compass, navigating you through the complex yet exhilarating world of blockchain investments.

Why It Is Considered the Future of Investments

Blockchain technology stands as a beacon of innovation, offering a myriad of investment opportunities that extend beyond the realm of cryptocurrencies. Its potential to revolutionize various industries, including finance, healthcare, and real estate, has caught the attention of investors worldwide. Moreover, its inherent features such as security, transparency, and immutability make it a promising avenue for investments.

As we venture further, we invite you to immerse yourself in this comprehensive guide, equipped with the knowledge and insights to make your foray into blockchain investments a successful one.

Understanding Blockchain Technology

In the dynamic world of investments, blockchain technology stands as a beacon of innovation and security. To fully grasp the potential it holds for investors, we first need to dissect its core components and functionalities. Let’s embark on this educational journey.

Blockchain technology, at its core, is a decentralized ledger that records transactions across many computers in a way that ensures the security of the data. It emerged in the late 2000s, spearheaded by an entity or individual known as Satoshi Nakamoto, primarily to serve as a public transaction ledger for the cryptocurrency Bitcoin. Over the years, it has evolved to find applications in various sectors, revolutionizing the way we perceive and handle transactions.

How Blockchain Works

To appreciate the investment opportunities that blockchain offers, understanding its working mechanism is crucial. Here’s a step-by-step breakdown of how it operates:

- Transaction Initiation: A user initiates a transaction, which is then verified by network nodes through cryptography.

- Block Formation: Once verified, the transaction is grouped with other transactions to form a block.

- Chain Addition: This block is added to a chain in a linear, chronological order.

- Immutable Record: Once added, the information becomes immutable, meaning it cannot be altered without altering all subsequent blocks, which requires a consensus of the network majority.

This process ensures a high level of security and transparency, making blockchain a reliable tool for various applications.

Comparison of Blockchain with Traditional Databases

| Aspect | Blockchain Technology | Traditional Databases |

|---|---|---|

| Centralization | Decentralized | Centralized |

| Security | High (Cryptography based) | Variable |

| Transparency | High (Public Ledger) | Limited |

| Cost-Effectiveness | High (Reduced intermediary costs) | Variable |

Benefits and Challenges

Investing in blockchain technology comes with its set of benefits and challenges that one must be aware of to make informed decisions.

Benefits:

- Security: Enhanced security through cryptographic techniques.

- Transparency: Public ledgers allow for transparent transactions.

- Efficiency: Streamlined processes with reduced intermediary involvement.

- Innovation: A gateway to new investment avenues and technologies.

Challenges:

- Volatility: The market can be highly volatile, posing risks.

- Regulatory Uncertainties: The regulatory landscape is still evolving.

- Technical Complexities: Requires a certain level of technical understanding.

- Potential for Misuse: Like any technology, it can be used for illicit activities.

Understanding these aspects will equip you with the knowledge to navigate the complex yet promising world of blockchain investments with confidence and foresight.

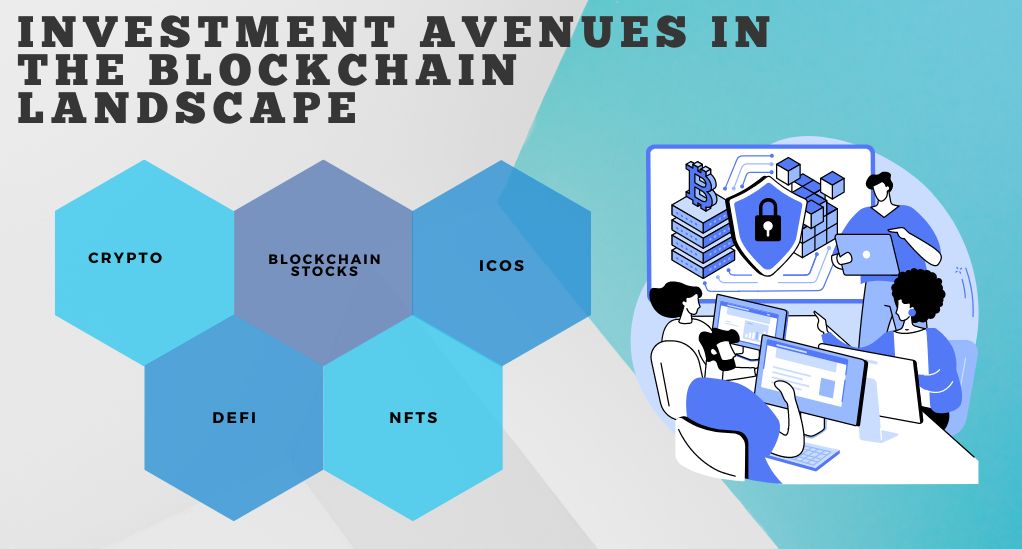

Investment Avenues

As we venture deeper into the realm of blockchain technology, it becomes evident that the investment opportunities are vast and varied. From cryptocurrencies to stocks and beyond, blockchain offers a plethora of avenues for both novice and seasoned investors. Let’s explore these avenues in detail.

1. Cryptocurrencies

Cryptocurrencies are perhaps the most well-known application of blockchain technology. These digital or virtual currencies use cryptography for security, offering a decentralized and often volatile investment option. Here, we delve into the prominent cryptocurrencies and their potential as investment assets.

Cryptocurrencies are perhaps the most well-known application of blockchain technology. These digital or virtual currencies use cryptography for security, offering a decentralized and often volatile investment option. Here, we delve into the prominent cryptocurrencies and their potential as investment assets.

Leading Cryptocurrencies and Their Features

| Cryptocurrency | Launch Year | Key Features |

|---|---|---|

| Bitcoin (BTC) | 2009 | First cryptocurrency, Limited supply, High value |

| Ethereum (ETH) | 2015 | Supports smart contracts, Platform for DApps |

| Binance Coin (BNB) | 2017 | Native coin of Binance exchange, Utility token |

| Cardano (ADA) | 2017 | Focus on sustainability, Peer-reviewed development |

2. Blockchain Stocks

Investing in blockchain doesn’t limit you to cryptocurrencies. Many companies are integrating blockchain technology into their operations, offering stocks that indirectly give exposure to the blockchain sector. These stocks can be a more stable investment compared to cryptocurrencies.

Companies Leveraging Blockchain Technology

| Company | Stock Ticker | Sector | Blockchain Application |

|---|---|---|---|

| IBM | IBM | Technology | Supply chain, Identity verification |

| Mastercard | MA | Financial | Payment processing, Fraud prevention |

| Square Inc. | SQ | Financial | Cryptocurrency trading platform |

| Overstock | OSTK | Retail | Cryptocurrency and blockchain ventures |

3. Initial Coin Offerings (ICOs) and Token Sales

Initial Coin Offerings (ICOs) and token sales represent another avenue for investment. These are fundraising mechanisms where new cryptocurrencies sell their underlying tokens to investors. It’s essential to conduct thorough research before investing in ICOs as they can be riskier compared to established cryptocurrencies.

4. Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is a system that aims to recreate and improve upon traditional financial systems, such as lending and borrowing, without a central authority. DeFi platforms operate on blockchain technology, offering a transparent and open-source alternative to traditional financial services.

5. Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) have emerged as a novel investment avenue in the blockchain space. NFTs represent ownership or proof of authenticity of a unique item, usually digital in nature. Investing in NFTs can be a lucrative venture, but it requires a deep understanding of the digital art and collectibles market.

Preparing to Invest

Before diving headfirst into the world of blockchain investments, it is essential to arm yourself with the right knowledge and tools. This section outlines the steps and considerations that prospective investors should undertake to ensure a successful and informed investment journey.

Research and Education

Understanding the Basics

- Blockchain Glossary: Familiarize yourself with common terms and jargon used in the blockchain space.

- Whitepapers and Case Studies: Delve into whitepapers of various blockchain projects to understand their vision and technical aspects.

- Community Engagement: Engage with communities and forums to gain insights and perspectives from other investors.

Market Analysis

- Historical Data Analysis: Analyze the historical data of potential investment assets to understand market trends and patterns.

- Industry News and Developments: Stay updated with the latest news and developments in the blockchain industry.

Understanding the Market Dynamics

Market Volatility

- Risk Assessment: Understand the inherent risks associated with blockchain investments, including market volatility.

- Investment Diversification: Learn the importance of diversifying your investment portfolio to mitigate risks.

Market Players

- Key Players: Identify and research the key players in the blockchain space, including developers, platforms, and influencers.

- Competitive Analysis: Conduct a competitive analysis to understand the strengths and weaknesses of various blockchain projects.

Risk Management Strategies

Financial Planning

- Budget Allocation: Determine the amount you are willing to invest and allocate your budget wisely.

- Emergency Fund: Ensure to have an emergency fund in place to safeguard against unforeseen market downturns.

Security Measures

- Secure Storage: Learn about secure storage options for your digital assets, including hardware wallets and secure passwords.

- Scam Awareness: Educate yourself on the common scams in the blockchain space and learn how to avoid them.

Getting Started with Investments

Embarking on your investment journey in the blockchain sector necessitates a well-planned approach. This section delineates the initial steps you need to undertake to set the stage for a successful investment venture.

Choosing the Right Platform

Cryptocurrency Exchanges

- Features and Usability: Evaluate different platforms based on their features, user interface, and reviews.

- Fees and Charges: Compare the fee structures of various exchanges to find the most cost-effective option.

- Security Measures: Ensure the platform has robust security measures in place to protect your investments.

Brokerage Firms

- Reputation and Reliability: Choose brokerage firms with a good reputation and reliable service.

- Customer Support: Consider the quality of customer support as it can be a vital aspect in your investment journey.

Creating a Digital Wallet

Types of Wallets

- Hardware Wallets: These are physical devices that store your assets offline, providing an added layer of security.

- Software Wallets: These are applications or software programs that store your digital assets online.

Security Protocols

- Private Keys: Understand the importance of private keys and how to safeguard them.

- Two-Factor Authentication (2FA): Implement 2FA to enhance the security of your digital wallet.

Making Your First Investment

Asset Selection

- Research: Conduct thorough research to select assets that align with your investment goals and risk tolerance.

- Market Timing: Learn about market timing strategies to make informed investment decisions.

Transaction Execution

- Order Types: Understand different order types, such as market orders, limit orders, and stop orders, to execute transactions effectively.

- Transaction Fees: Be aware of the transaction fees associated with buying and selling assets.

Legal and Ethical Considerations

As you navigate the promising yet complex world of blockchain investments, being cognizant of the legal and ethical landscapes is paramount. This section sheds light on the regulatory frameworks governing blockchain investments and the ethical considerations to bear in mind.

Regulatory Landscape

Navigating the complex world of blockchain investments necessitates a deep understanding of the global regulatory landscape. Various countries have distinct regulatory bodies that influence the direction and stance on blockchain investments, creating a diverse and multifaceted investment environment. As an investor, acquainting oneself with the roles and guidelines of these entities can offer a nuanced view of the global intricacies in blockchain investments.

Moreover, adherence to compliance requirements and reporting standards is a cornerstone of responsible investment in the blockchain sector. Familiarizing oneself with these aspects not only aligns with legal frameworks but also promotes transparency and accountability. Hence, a thorough understanding of these standards is vital for a secure and enlightened investment journey.

Ethical Considerations

Environmental considerations hold significant weight. It’s essential to be cognizant of the environmental impacts associated with blockchain technology, notably the high energy consumption of certain cryptocurrencies. As a proactive step, investors are encouraged to explore blockchain projects that are adopting sustainable practices to lessen their environmental footprint, fostering a greener approach to technological advancement.

Simultaneously, embodying social responsibility is a cornerstone in fostering a conscientious investment environment. Engaging with the community not only enriches one’s understanding but also nurtures a responsible investment ecosystem. Moreover, considering the broader social implications of blockchain projects can guide investors to make ethical investment choices, thereby contributing positively to the societal fabric while navigating the investment landscape.

Protecting Your Investments

Safeguarding your assets should be a priority. It is vital to acquaint yourself with the various measures in place to prevent fraud and protect your investments. Understanding the recovery protocols that exist to shield your assets in the event of security breaches can be a significant step towards ensuring a secure investment journey.

Furthermore, considering insurance coverage can be a prudent strategy in asset protection. Investors are encouraged to explore various avenues to insure their digital assets against potential losses. Simultaneously, implementing risk mitigation strategies can serve as a robust defense against market volatility and other prevalent risks, fostering a resilient and secure investment portfolio.

Future Prospects of Blockchain Investments

As we stand at the forefront of a technological revolution, it is vital to cast a discerning eye on the horizon to gauge the potential trajectories blockchain investments might take. This section delves into the emerging trends, potential growth areas, and expert predictions that paint a picture of the promising future that blockchain investments hold.

Emerging Trends

Integration with Other Technologies

- Internet of Things (IoT): Explore how blockchain can enhance security and transparency in IoT networks.

- Artificial Intelligence (AI): Understand the synergies between blockchain and AI, and how they can foster innovation.

Cross-Chain Interoperability

- Seamless Transactions: Learn about the developments in cross-chain interoperability facilitating seamless transactions between different blockchains.

- Unified Ecosystems: Discover how interoperability can lead to unified ecosystems, enhancing efficiency and user experience.

Potential Growth Areas

Decentralized Finance (DeFi)

- Financial Inclusion: Delve into how DeFi can foster financial inclusion by offering services without the need for traditional banking systems.

- Innovative Financial Products: Learn about the innovative financial products and services that DeFi platforms are bringing to the market.

Non-Fungible Tokens (NFTs)

- Digital Art and Collectibles: Explore the burgeoning market of digital art and collectibles facilitated by NFTs.

- Real Estate and Intellectual Property: Understand the potential of NFTs in revolutionizing real estate transactions and intellectual property management.

Expert Predictions

Market Dynamics

- Market Valuation: Analyze expert predictions on the potential market valuation of blockchain technologies in the coming years.

- Investment Strategies: Gain insights into the investment strategies recommended by experts for navigating the evolving blockchain space.

Regulatory Developments

- Future Regulations: Stay abreast of the potential regulatory developments that might shape the blockchain investment landscape.

- Global Adoption: Understand the prospects of global adoption of blockchain technology and its implications on investments.

Conclusion

As we navigate through the intricate tapestry of blockchain technology and its investment avenues, it becomes evident that we are witnessing a paradigm shift in the financial landscape. The decentralized nature of blockchain not only fosters transparency and security but also opens up a realm of opportunities for investors seeking to diversify their portfolios and venture into innovative financial territories.

From understanding the foundational aspects of blockchain technology to exploring diverse investment avenues and preparing oneself for the investment journey, we have traversed a comprehensive path in this guide. As we stand at the cusp of a new era, it is imperative to approach blockchain investments with a well-informed and responsible mindset, considering both the promising prospects and the inherent risks.

As you embark on your investment journey, remember that the blockchain space is ever-evolving, characterized by innovations and developments that hold the potential to reshape industries and economies. Armed with knowledge and insights, you are now equipped to navigate this dynamic landscape with confidence and foresight.

Leave a Reply